If you are a resident of Maharashtra and dreaming of starting your own business, the Annasaheb Patil Loan Scheme 2025 can be your launchpad. Designed especially for the financially weaker sections and unemployed youth, this scheme provides business loans ranging from ₹10 lakh to ₹50 lakh.

In this blog, we’ll guide you through how to Annasaheb Patil loan apply online, the eligibility criteria, benefits, interest rate, and step-by-step application process. Let’s dive in.

Table of Contents

What is the Annasaheb Patil Loan Scheme 2025?

The Government of Maharashtra introduced the Annasaheb Patil Economic Backward Development Corporation Loan Scheme to promote self-employment and entrepreneurship. Under this scheme, eligible citizens can get financial assistance in the form of loans with up to 5 years repayment time.

Main Objective of the Scheme

The primary goal of this scheme is to support the economically weaker citizens, especially the unemployed youth, by offering them the capital needed to start or expand their own businesses. This not only helps the individuals but also generates job opportunities for others.

✅ Key Highlights of Annasaheb Patil Loan Scheme

| Feature | Details |

|---|---|

| Scheme Name | Annasaheb Patil Loan Scheme 2025 |

| Launched By | Maharashtra State Government |

| Loan Amount | ₹10 Lakh to ₹50 Lakh |

| Repayment Tenure | Up to 5 years |

| Interest Rate | 12% per annum |

| Beneficiaries | Permanent residents of Maharashtra |

| Application Mode | Online |

| Official Website | Udyog Mahaswayam |

| Customer Support | 1800-120-8040 |

📌 Eligibility Criteria

Before you begin the Annasaheb Patil loan apply online process, make sure you meet the following conditions:

- Must be a permanent resident of Maharashtra.

- Must belong to the economically weaker section.

- Should have a valid business idea or plan.

- Must possess the Mandal eligibility certificate.

- Applicant must upload the loan details on the Mandal web portal after approval.

- In case of collateral-free loans, Mandal guarantee approval is required.

📄 Documents Required

To ensure a smooth application process, keep these documents ready:

- Aadhaar Card

- Address Proof

- Caste Certificate (if applicable)

- Income Certificate

- Business Plan or Proposal

- Bank Account Details

- Passport-size Photo

- Mandal Eligibility Certificate

💰 Types of Loans Available Under the Scheme

- Personal Loan – Interest Repayment Plan

- Group Loan – Interest Repayment Scheme

- Group Project Loan Scheme

These loan types allow flexibility depending on whether you’re applying individually or as a group.

💸 Interest Rate and Charges

- Interest Rate: 12% per annum

- Repayment Period: Up to 5 years

- Processing Charges: Minimal (as per respective banks like Central Bank of India)

🌐 How to Apply for Annasaheb Patil Loan Online

Here’s the step-by-step guide for Annasaheb Patil loan online apply:

Step 1: Visit the Official Website

Go to the Udyog Mahaswayam website: www.mahaswayam.gov.in

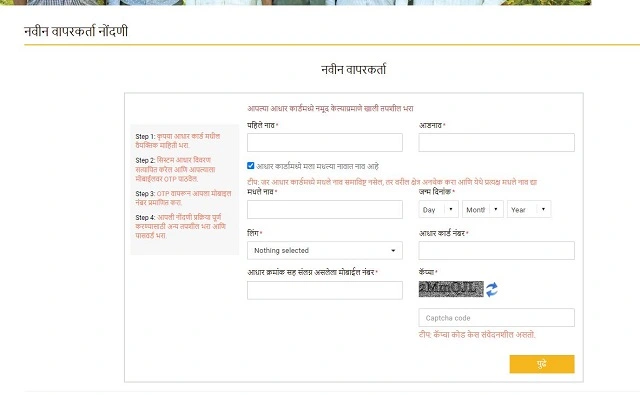

Step 2: Register Yourself

Click on “Register Now” on the homepage and enter your:

- Full Name

- Date of Birth

- Gender

- Aadhaar Number

- Mobile Number

Step 3: Verify via OTP

You will receive a One-Time Password (OTP) on your mobile. Enter it to verify.

Step 4: Fill the Application Form

Provide all necessary details, upload documents, and mention your business plan and loan amount.

Step 5: Submit the Form

Click on “Submit” and your application for Annasaheb Patil Loan Scheme will be processed.

🏦 Online Apply Annasaheb Patil Loan Central Bank of India

Central Bank of India is one of the key partner banks for this scheme. If you are already a customer or plan to apply through this bank, make sure to mention it while applying. The loan approval and processing may vary slightly depending on the bank, but the core process remains the same.

🎯 Benefits of the Annasaheb Patil Loan Scheme

- Financial help of up to ₹50 lakh.

- Easy online application process.

- Collateral-free loans available in some cases.

- Flexible repayment period of 5 years.

- Encourages youth entrepreneurship and job creation.

📞 Contact Details for Help

If you face any issues while applying online, reach out to the helpline:

- Toll-Free Number: 1800-120-8040

🔍 Conclusion

The Annasaheb Patil Loan Scheme 2025 is a powerful initiative for self-employment and economic growth in Maharashtra. If you’re eligible and have a solid business plan, don’t miss this opportunity.

Start your entrepreneurial journey today with a simple Annasaheb Patil loan apply online process and turn your dreams into reality.